All you need to know about annual publication

Date published: 20 January 2022

Each year we publish the full details of MPs’ staffing and business costs for the previous financial year.

Annual publication is the final figure for the financial year including all claims, repayments and staffing costs.

You can find details on the claims made in the 2020-21 financial year by visiting MPs’ staffing and business costs.

It's tempting to compare MPs against each other to assess their value on how much or how little they have claimed, but such comparisons don’t always reflect the reality of their roles.

In What do MPs spend public money? on we talk about the budgets available to MPs, and in Why does MPs’ spending vary so much? you can read about the various factors that affect how much MPs need to claim to do their job.

Here we examine some aspects of annual publication and provide insight into how the data can be properly assessed.

Business costs

These are claims made by MPs to cover the business costs they incur while carrying out their parliamentary duties.

The payments are for goods or services supplied to MPs, such as rent, travel and stationery. Claims must be compliant with our rules and accompanied by evidence. Business costs are not part of an MPs’ pay.

Staffing

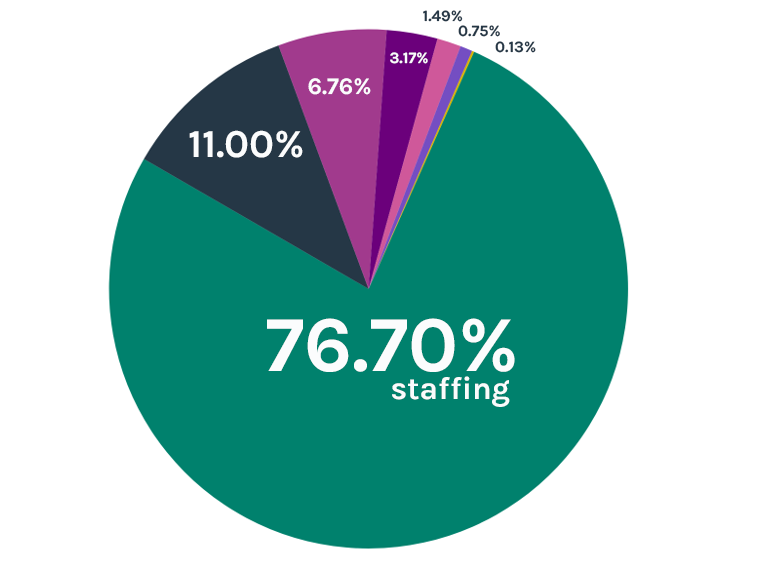

The majority – 76.70% – of MPs’ costs are for their staff.

The Staffing budget allows MPs to recruit a small team to help them support their constituents.

On average they each employ five members of staff to help respond to requests from local people, resolve issues and represent their needs in Parliament.

If you remove staffing costs from the MP's total, you will notice how much lower it is.

| Budget type | Amount | Overall % |

| Staffing | £105.8m | 76.70% |

| Office | £15.2m | 11.00% |

| Accommodation | £9.3m | 6.76% |

| Security | £4.4m | 3.17% |

| Travel and Subsistence | £2.1m | 1.49% |

| Other | £1m | 0.75% |

| Disability | £176k | 0.13% |

Personal costs

MPs are not allowed to claim for personal costs.

They can’t claim the cost of food and drink during their normal working day, although they can claim a modest amount of subsistence of £25 per day if they are away from London or their constituency for parliamentary purposes. This is similar to what happens in other jobs where you are required to travel on business.

MPs can’t claim for their daily commute to work at either their constituency office or the Houses of Parliament. For those MPs with constituencies beyond London, they can claim the cost of travel to London to represent their constituents. MPs can claim for other journeys for parliamentary purposes.

They also can’t claim the cost of a second home. Non-London MPs can only claim for hotels, rented accommodation or associated costs in either London or their constituency while they fully fund their accommodation in the other location.

The pandemic

At the start of the pandemic, we increased each MP's Office Costs budget so they and their staff could quickly transition to homeworking and continue supporting constituents and dealing with the huge surge in casework due to the hardships people were suffering.

The budget provided for a range of necessary services and equipment for MPs and their teams.

We also increased the staffing budget to help MPs’ offices respond to those affected by the pandemic and resolve issues including those regarding physical health, mental health, social care and housing.

We carried out a survey of MPs and their staff in the summer of 2021 in which 97% of respondents reported a large increase in casework following the onset of the pandemic with 90% of respondents reporting that casework was more complex and time-consuming than before.

The additional covid funding we provided was essential to help MPs and their staff to assist people during this very difficult time.

Compliance

Although the total figure for MPs' staffing and business costs may appear to be high – higher than many of us spend in a year – MPs each represent approximately 70,000 people in their constituencies and often work between two locations.

Our data tells us that claims made by MPs are 99.7% compliant with our rules and that the small proportion of non-compliance is often the result of mistakes or misunderstandings.

Since the 2009 expenses scandal, we have provided clear rules and robust regulation to make sure claims are legitimate.

Almost 600 of the current 650 MPs joined Parliament since 2009, and the IPSA system is all they have ever known.

How to review the data

Reviewing the total spend data to assess the value of your MP is difficult.

You need to consider how many staff your MP employs and the sorts of jobs they perform. You should also consider how events over the past year might have affected people in your area and whether your MP might have had to ask staff to work overtime or bring in extra staff to provide support.

If your MP has a constituency office, you should consider how expensive rent is in your area and examine how the Office Costs budget has been used to provide information and support through digital or print channels, or by hosting local meetings and events.

When looking at the Travel budget you should consider how far your constituency is from Westminster and how many journeys your MP made locally to meet constituents, or further afield to support their parliamentary work.

With the Accommodation budget, consider how many nights your MP spent away from home in a hotel or rented accommodation while having to work from two locations.

IPSA is dedicated to independently setting, administering and regulating MPs business costs.

Given the unique circumstances of their roles and the safeguards we have in place, the best way to assess the value of your MP is to focus on the impact they have within your constituency and the service they provide to the people they represent.